Helping young Kuwaitis get a better grasp on their financial planning

Helping young Kuwaitis get a better grasp on their financial planning

Edit budget

See insights

BUDGET CATEGORIES

Shopping

60

.000

spent of 100.000

Fees, Fines & Loans

25

.000

spent of 50.000

Vacation & Travel

30

.000

spent of 120.000

Education

15

.000

spent of 20.000

Personal Care

15

.000

spent of 60.000

Home

5

.000

spent of 20.000

OTHER CATEGORIES

Insurance

45

.000

General

15

.000

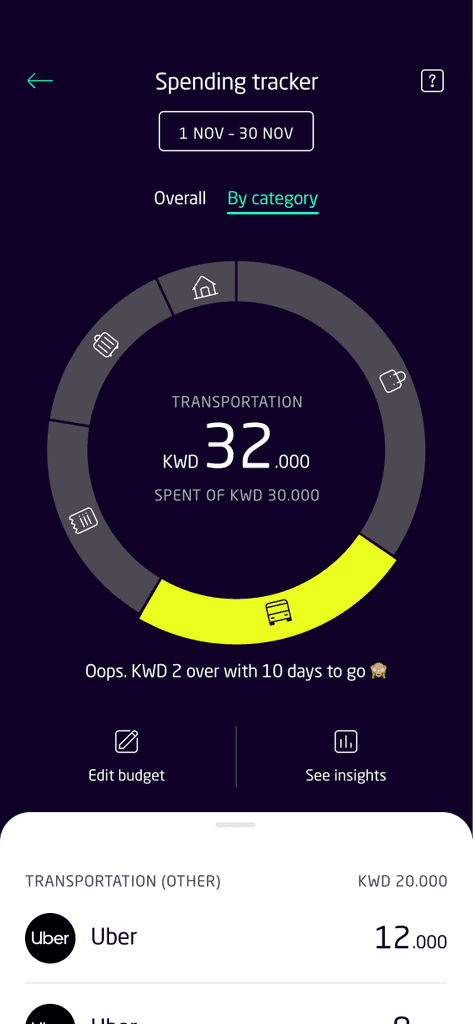

Spending tracker

1 NOV – 30 NOV

Overall

By category

KWD

97

.802

Spent of KWD 500.000

Nice work. KWD 375 left with 21 days to go 👏🏽

Year

2022

Duration

3 months

Role

User research, prototypying,

UI Design

Build & maintained Design System

Product

iOS & Android

Impact

A remarkable average monthly growth rate of 61% in customer bookings.

An above-industry-average Net Promoter Score (NPS) of 70/100.

National Bank of Kuwait launched the first fully digital bank in Kuwait called Weyay (‘with me’), designed to serve the financial and lifestyle needs of young Kuwaitis.

When I joined the team, 3 months after starting the project as the 2nd squad was consolidating, The project it was lead by R/GA from UK, and 3 product designers in-house were added to the business squads. After this first phase, I became one of the most senior product designer of Weyay, and I had to onboard multiple designers who.

(Illustration credit goes to Tom Strand)

Outstanding Innovation in Mobile Banking (2022)

Most Innovative App for Young People (2024)

Designed to serve the financial and lifestyle needs of shabab (Kuwaiti youth)

Weyay products and services aim at young people needs since around 66% of Kuwait’s inhabitants are under 34 years old.

Since our launch on earlier that year, it was time to start gathering some conclusions

Using tools such as Clevertap we could analize the behavior of our users. We saw that 20% of them would not fund they account.

We decided to send a expand on our research, including interviews and suveys, at the beginning of the programme

One the key insights was 91% of pople agreed that financial starts with clarity and control.

We learned that users wanted more help to manage their finances using digital tools. 80% said they were looking for tools to help them set personal saving goals and track their money. Many use external apps or methods outside of their regular banking app to achieve this.

They need the right tools to make banking more manageable

Objective

Measuring the level of customer satisfaction and loyalty amongst Weyay Bank and identify potential areas to be improved

Methodology

Quantitative Research using an online survey via email

Sample size

54.000 surveys sent

1.241 survey responses (2% response rate)

Competitors such as Warba Bank provide comprehensive budget and saving experiences but they are highly functional without much guidance and clarity. Users are on their own to take action and next steps.

"I want a bank that is easy, simple, and I can organize everything and get everything with easy."

"KFH Bank was very old with no innovation, it's hard and complicated to use."

Managing money should feel quick and achievable, putting them in control and closer towards gaining independence.

Value proposition

The mobile-only bank for the mobile generation

Experience pilars

Take control of your money

Unlock your future

Experience principles

Accelerate

Simplify

Empower

Provide knowledge

Reward

Provide motivation

Design principles

Easy to use

Simple design

Digestible

visualization

Informal

Goals

60%

60%

60%

Provide knowledge

We conducteed testing with Teenagers and young adults

(5 teenagers, 5 students)

After conducting research among 15 and 24 year-olds, with 80% saying they were looking for tools to help them set personal saving goals and track their money. Many use external apps or methods outside of their regular banking app to achieve this. we learned what motivates young Kuwaitis and how we can help them manage their finances using digital tools.

Design System

The complex nature of the app necessitated more than 70 screens covering user on-boarding, Wi-fi setup, support and power user features like port forwarding.

To maintain consistency and ensure efficient design to dev handover, I developed a modular design system based on reusable components and their states, such as cards, list items, and controls. Every component can be rearranged and combined with others while maintaining design consistency and recognizable UI patterns for the user.

Spending tracker

1 NOV - 30 NOV

MONEY TIPS

3

Shopping

Change category

Shopping

Change category

Education

15

.000

Education

15

.000

spent of 20.000

Education

Over budget

15

.000

spent of 20.000

Education

20

.000

KWD 70.000 spent last month

Jewellery & Accessories

75

.000

What’s your budget?

Set monthly limits to keep your spending on track.

What’s your budget?

Set monthly limits to keep your spending on track.

Primary

What’s your budget?

Set monthly limits to keep your spending on track.

Secondary

Primary

What’s your budget?

Set monthly limits to keep your spending on track.

What’s your budget?

Set monthly limits to keep your spending on track.

Primary

What’s your budget?

Set monthly limits to keep your spending on track.

Secondary

Primary